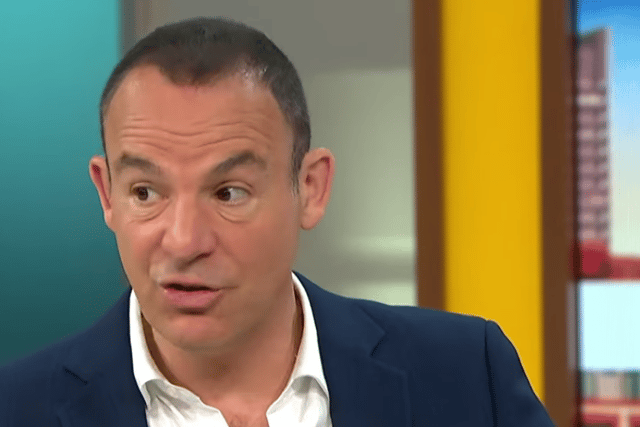

Martin Lewis explains best way to get travel money - should I exchange cash or use a debit card abroad?

and live on Freeview channel 276

Martin Lewis has issued important advice to anyone who has a holiday booked this year. The consumer champion dished out the money-saving tip, which concerns travel cash, on Tuesday’s (May 9) episode of This Morning.

The programme saw a caller ask Mr Lewis for some advice about travel money ahead of an upcoming trip. They asked the MoneySavingExpert (MSE) founder: “Is it cheaper to use my Barclays contactless card over there or should I get Euros at the post office?”

Advertisement

Hide AdAdvertisement

Hide AdMr Lewis urged the viewer to take a different course of action instead, saying “don’t do that”. He told them: “Neither of those are particularly good options.

“If you’re going to get travel cash then get yourself on to a travel money comparison site to get yourself the very best rate. The cheapest way to spend abroad is to use the right plastic.

“You do not have the right plastic. When you spend abroad, for every £100 that you spend , normally the bank is charged £100 worth. But then they add what is called a non sterling transaction fee onto the bill that you get.

“With Barclays I think it’s roughly per cent, so you would pay £103 for your £100 of Euros - but there is a range of specialist cards that don’t add that fee and also have lower charges for cash withdrawal.”

Advertisement

Hide AdAdvertisement

Hide AdMr Lewis told viewers the top debit card is the Chase card. He said: “This gives you the same near perfect rate the bank does, and 1per cent cashback on spending in the UK and abroad.

“So effectively, it’s even cheaper than the bank gets. Capped up to £15 a month.”

When it comes to credit card, Mr Lewis explained the Barclaycard reward card is the best option. He added: “That gives you a 0.25 per cent cashback and perfect rates abroad.

“With that one of course, you have to pay it off in full.”