New cars sales plummet 30% in ‘lost year’ of 2020

The UK’s new car market contracted by 30 per cent in 2020 as the effects of the Covid-19 pandemic and economic uncertainty around Brexit took their toll on the industry.

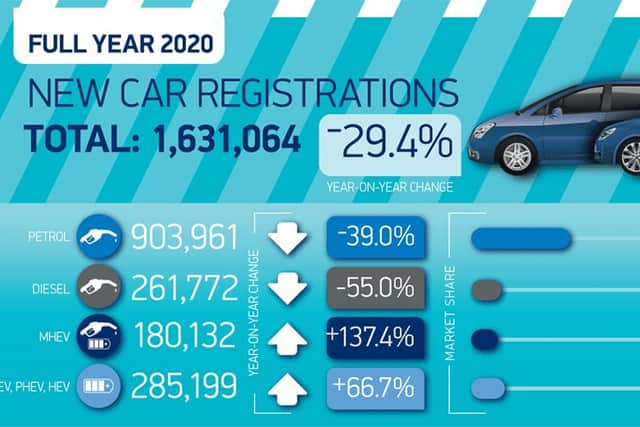

Figures released by the Society of Motor Manufacturers and Traders (SMMT) showed a 29.4 per cent decrease in the number of new car registrations, making 2020 the worst year for the auto industry since 1992.

Advertisement

Hide AdAdvertisement

Hide AdA total of 680,076 fewer cars were registered compared to 2019, equivalent to £20.4 billion in lost turnover, according to the body which represents car makers and sellers in the UK.

The new car industry was battered by the effects of the Covid-19 outbreak, which affected vehicle production and supply and forced dealerships to close for months. The outbreak also hit consumer confidence as people looked to reduce spending and concerns over a post-Brexit trade deal are also thought to have affected interest in new models.

Mike Hawes, chief executive of the SMMT, said: “2020 will be seen as a ‘lost year’ forautomotive, with the sector under pandemic-enforced shutdown for much of the year and uncertainty over future trading conditions taking their toll. However, with the rollout of vaccines and clarity over our new relationship with the EU, we must make 2021 a year of recovery.”

While the overall figures were significantly down, sales of battery electric vehicles and plug-in hybrids (PHEVs) bucked the trend and increased. In fact, the all-electric Tesla Model 3 was December’s best-selling model.

Advertisement

Hide AdAdvertisement

Hide AdOver the course of 2020, EV registrations grew by 185 per cent to 108,205 units while PHEVs rose 91 per cent to 66,877. Between them they accounted for more than one in 10 registrations compared to one in 30 in 2019.

In contrast, petrol car registrations fell 39 per cent and diesel was down 55 per cent to a market share of just 16 per cent.

Ian Plummer, commercial director of Auto Trader predicted that if the current trend continued, EVs would overtake diesel registrations this year.

He said: “With consumer interest in greener technologies increasing, coupled with a plethora of new models now available, the green transition has certainly begun. If we were to see this continued level of uptake in EVs then we anticipate that sales of new EVs and plug in hybrids will overtake diesel cars in 2021, and then pure EVs will overtake those of their internal combustion engine counterparts in 2026.”

Causes for optmism

Advertisement

Hide AdAdvertisement

Hide AdDespite the sharp decline in registrations, industry observers said there were positives to be taken from how dealers responded to the challenges of 2020, including a swift adoption of online services.

Jim Holder, editorial director of What Car? commented: “The rapid digitalisation of the sector is a cause for optimism – offering buyers the chance to interact with retailers and manufacturers through innovative new online services. Since March, manufacturers and retailers have invested significantly in virtual showrooms, online sales portals and other live retail packages.”

Karen Hilton, chief commercial officer at heycar, added: “As forecourts shut once again, the industry is set for more pain in the early part of the year. But, if 2020 has proved one thing it is how resourceful the sector can be.

“Getting stock online, offering video viewings and free delivery as well as enabling more people to complete more of their buying journey from home all helped compensate for significant interruption to business from March onwards.

Advertisement

Hide AdAdvertisement

Hide Ad“A welcome consequence of that is that many dealerships now have the online infrastructure and vital knowhow to operate virtually, allowing them to continue to engage and sell to customers.

She also predicted that the current situation offered a “golden opportunity” for the used car market.

“The new car market is still facing its own particular challenges - with production delays and long lead times for certain new models. For many car buyers in the first few months of the year, a used car may be their only option.

“By highlighting the great value nearly-new and pre-reg vehicles offer, alongside the extensive choice and immediate availability of stock - dealers can make real gains.”

Advertisement

Hide AdAdvertisement

Hide AdThis was echoed by Alex Buttle, director of used car marketplace Motorway.co.uk, who said: “The used car market is likely to be the main beneficiary of a slow new car market, as buyers look to find more value with their purchases.

“Although finances are tight for most, many households do have money to spend as they’ve been able to save over the past 12 months while in lockdown. However, with potential job losses and tax rises on the horizon, they’re more likely to moderate their spending, by avoiding more expensive new vehicles to focus on quality used cars.”